|

Friday, 12 April 2019

quote [ Instead of taking out loans, students can agree to hand over part of their future earnings in return for investment. ]

|

Comments

|

ComposerNate said @ 7:17am GMT on 12th Apr

[Score:2 Underrated]

The US is brutal on students

|

|

mechavolt said[2] @ 1:45am GMT on 12th Apr

The version of this I like is funded through the schools, not the employers directly.

What I like about this is that it incentives colleges to be concerned about their students' success. The better the student does post-schooling, the more money the college recoups. However, I have a couple of concerns. The first is that there would be a clear preference for higher earning degrees. While some might argue that's just realistic, I fear there's a risk that valuable degrees that don't pay well might be under-served. The second is that this only works if the students graduate. I imagine that if they don't, they'd be on the hook for the entire cost. However, the graduation rate for higher education is surprisingly low. Though to be fair, this isn't a problem that's any worse than what's currently the case. But schools might focus on a smaller number of less risky students if the cost of helping less proficient students is too high for them. |

|

zarathustra said @ 1:50am GMT on 12th Apr

It sounds interesting, but I would be curious to actually read the contract. Am I obligated to make the most money I can in my field or can I enter a lower paying branch ( for example decide I would rather use my law degree to work at a charitable clinic than in a big firm). What if I want to change majors or even do something completely outside my major after graduation.

|

|

JWWargo said @ 2:33am GMT on 12th Apr

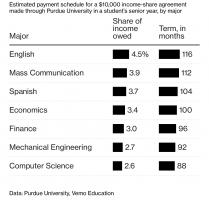

Purdue, for example, caps total payments at 2.5 times what a student borrowed, so the most successful don’t feel gouged. And students making less than $20,000 a year won’t be charged at all, as long as they are working full time or seeking work. Those who are working part time or not seeking work will only have their payments deferred, which means that they’ll owe for a longer period of time.

|

|

zarathustra said[1] @ 3:18am GMT on 12th Apr

That doesn't address the questions I asked.

|

|

JWWargo said @ 4:21am GMT on 12th Apr

I believe it answers the first question. At least in the sense that if you use that Law degree to work full time for a charity and only make 20k a year, you won't have to pay anything back.

|

|

zarathustra said @ 4:42am GMT on 12th Apr

No. It does not say if the party has a duty to maximize return. If one can only find a 20k job, they may not have to pay it back. It says nothing about if they choose an under performing ( financially) job when they had other options. Do they or do they not have a duty to make an effort to maximize profits for their investors? While only finding a 20k job might when nothing else is offered to them may be fine. Choosing the 20k job while turning down a better paying one may not be.

|

|

JWWargo said @ 7:44am GMT on 12th Apr

That's not how I understood it to work. It's a percent of your earnings for a fixed period of time. So if you had a high paying job, yeah, you may end up paying more but, at least as Purdue has it set up, you won't pay more than 2.5 times over what you borrowed. To simplify things, take a 10k loan, graduate and get a 21k a year a job, repay the loan at 2 percent for 10 years, and if you somehow never get a raise or change jobs in that time, you'll end up paying 4.2k back. A loss for the investor. (Am I missing something here?)

Real world scenarios probably won't play like that, but I didn't see anywhere where investors had any leverage to push you into making larger payments. I think the really imoortant question is whether it turns out you pay more in the end than you would with a student loan. |

|

zarathustra said @ 1:15am GMT on 13th Apr

[Score:1 Informative]

I did a bit of research and it seems that the Purdue contract is written in pretty much the way you understand it with a bit of wiggle room regarding potential fraud in the application and that they determine what constitutes reasonable efforts to find a job when seeking deferment. There is some questionable stuff about your financial disclosures to them and how they may share it with others, but it does look overall pretty good.

My questions were mostly based on if this is to be characterized as a loan or a service contract or investment vehicle where you could have a fiduciary duty to maximize the investors return. While that is not the case here, a bill proposed by Rubio a couple of years ago ( I don't know if it got though) made it explicit that they recipient could not be penalized for their choice of work ( or lack theirof) implying that this could be a concern in such contracts. On of the interesting things I came upon was a group offering such loans that combined it with mentoring. It makes sense that those investing in you might also make some effort to maximize their profit by helping you find a good job. ( Though again, in this case their might be some issues if they tried to make you work for them.) Overall I would say this kind of arrangement looks good but approach with caution. |

|

milkman666 said @ 10:48am GMT on 12th Apr

"John, this morning I received this list of demands from our workers. They are going to strike if we don't meet them."

"Woah woah woah, Peter! How did they even get organized?! We have procedures in place to..." "One of our competitors bought out the ISA's for more than half of our workers. They either comply or they get term extensions and or penalties. They have to play ball. John, enough of the other workers are on board to make this happen." "Which competitor?" "You know which one." *Both shaking fists and yelling into the ceiling in unison* "Marjorie!" |

|

arrowhen said @ 4:05pm GMT on 12th Apr

Three pints of damn and a chaser of hell blast!

|

|

-_- said @ 5:24am GMT on 12th Apr

https://www.tor.com/2009/03/04/lemgthe-unincorporated-manlemgin-60-seconds/

|

Post a comment

[note: if you are replying to a specific comment,

then click the reply link on that comment instead]You must be logged in to comment on posts.

Soft paywall, full article in extended.